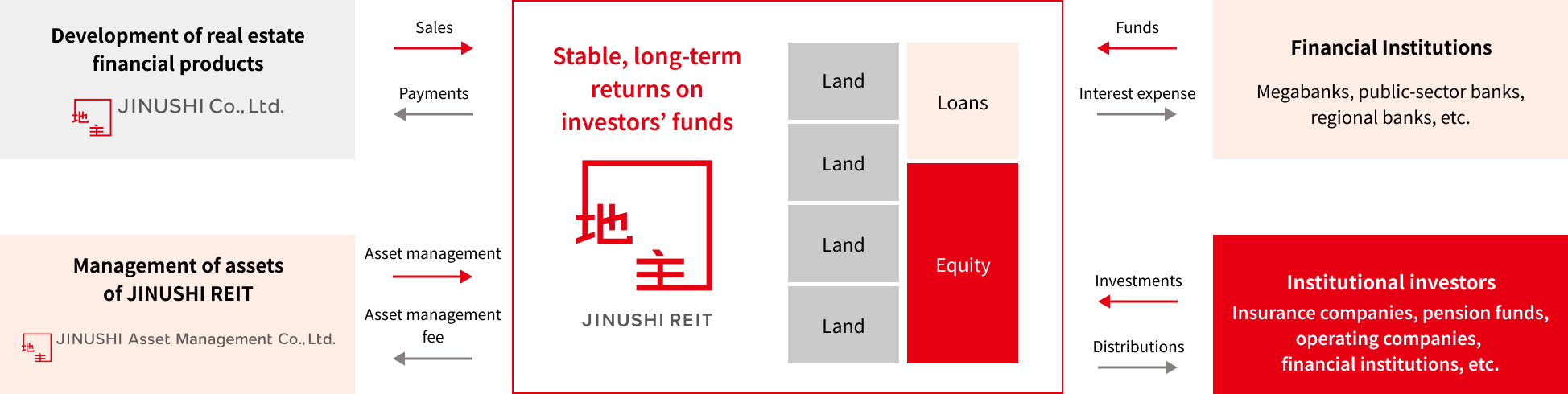

What is JINUSHI REIT?

As the only private REIT specializing in fixed-term land leasing in Japan, we provide stable long-term management of the funds of institutional investors. We have established a reputation as a "stable landlord" from tenants who desire long-term and stable business operations.

291.1billion yen

(7 th/out of 61 stocks)

215properties

(1 st/out of 61 stocks)

Only leased land

(only fund of this type in Japan)

359companies

Approx.

4%

AA-

(stable)

*As of January 8, 2026. Based on our research (other issues are as of December 31, 2025).

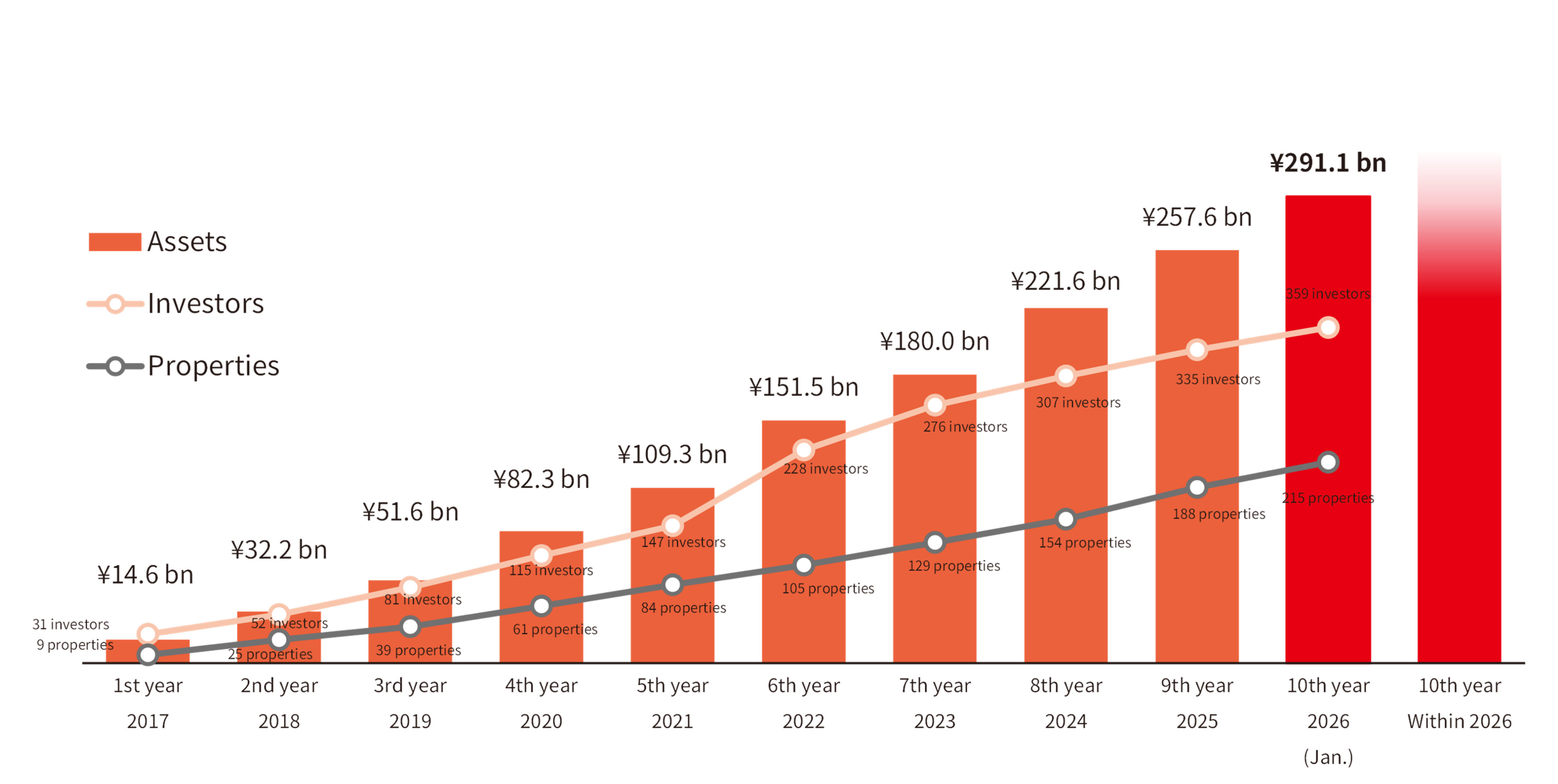

Change in Asset Scale

In January 2026, JINUSHI REIT has completed its 10th consecutive capital increase, bringing assets under management to ¥291.1 billion. It aims to achieve AUM of ¥300.0 billion, and to reach ¥500.0 billion at an early stage thereafter.

*All numbers in this graph are the amounts immediately after each offering. (Assets in each year are based on appraised values when acquired)