According to a survey by the Japan Real Estate Institute, the size of the Leasehold land leasing market will expand significantly from about 6 trillion yen in 2023 to about 10 trillion yen in 2026.

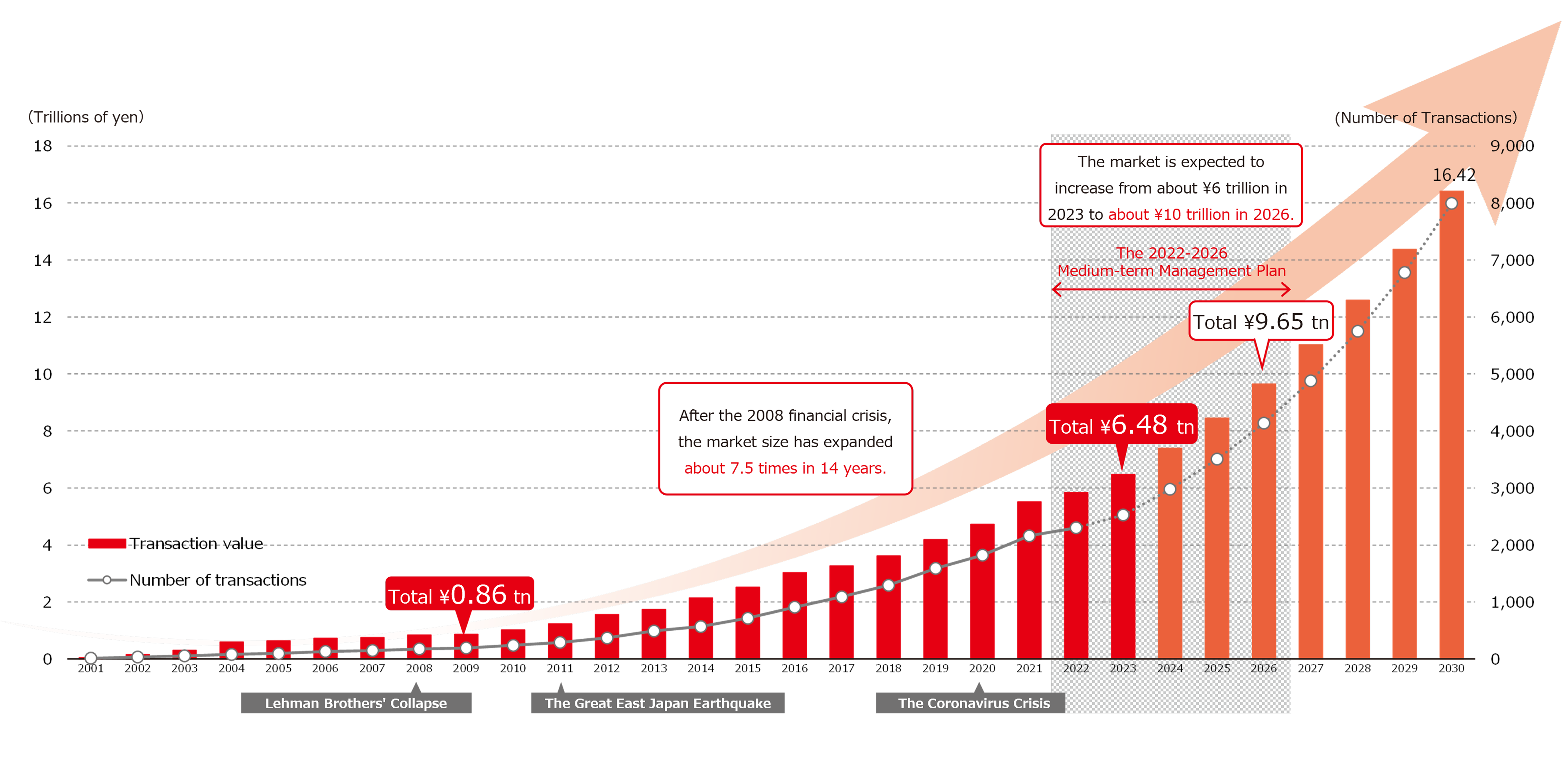

Transition and forecast for land leasing market (total value of land leasing transactions)

- After the 2008 financial crisis, the market size has expanded about 7.5 times in 14 years.

- The market's liquidity is increasing as more institutional investors recognize the ability of leased land investments to generate stable income for many years.

- The market will expand significantly from about 6 trillion yen in 2023 to about 10 trillion yen in 2026.

* Cumulative leased land transaction value is calculated using publicly announced transactions between 2001 and 2023.

* The average year-on-year growth rate of total land leasing transactions from 2013 to 2026 (amount: +14.3%, number of transactions: +20.2%) remains at the same level. We are forecasting based on the assumption that the transaction amount of land leasing will continue to grow after 2023.

* The calculation of the volume of the leased land market uses the property price index and other data of the Ministry of Land, Infrastructure, Transport, and Tourism, conservative assumptions for the percentage of publicly announced transactions that are for leased land, and the forecast for monetary transaction volume including transactions that are not made public.

* The figures in these graphs were calculated by the Japan Real Estate Institute using the above assumptions. These projections are not guarantees concerning the future growth of the leased land market in Japan.