Process of formulation

Step1

Considered a wide range of long-term social issues linked to Our business and activities.

We examined the long-term outlook, including global environmental and social issues, using international guidelines such as the GRI Standards, SASB Standards, and ISO 26000, as well as information from external consulting firms, to identify social issues that are highly relevant to our business.

Step2

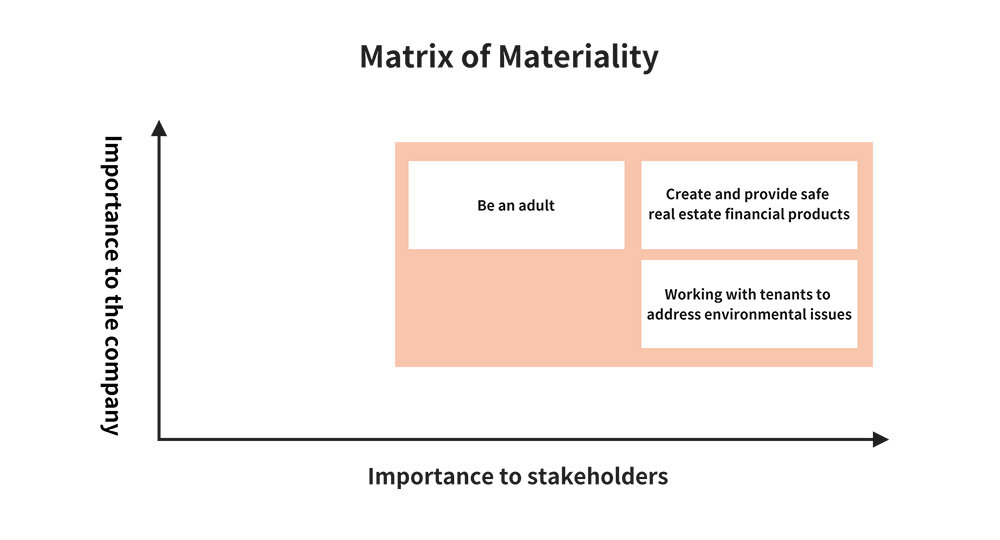

Identified factors that are important to us and our stakeholders.

Based on the social issues identified in STEP 1, ESG Committee members and others identified important factors based on two criteria: importance to the company and importance to stakeholders.

Step3

Identified Materiality, set goals and KPIs

The results of STEP 1 and 2 are discussed by the ESG Committee (Chairman: President & CEO), and targets and KPIs are determined, and submitted to and reported by the Board of Directors.

Materiality

|

Materiality |

Opportunities and Risks ( ● Opportunity 〇 Risk ) |

Actions |

|---|---|---|

|

Create and provide safe real estate financial products |

|

|

|

Working with tenants to address environmental issues |

|

|

|

Be an adult |

|

|

Indicators and Targets

|

Targets (FY12/26) |

Recent results (FY12/24) |

|

|---|---|---|

|

Managed assets of JINUSHI REIT |

300 billion yen |

257.6 billion yen※1 |

|

Continued to achieve 100% incorporation of ESG clauses into land lease agreements with tenants.※2 |

100% | 100% |

|

CO2 emissions (JINUSHI emissions) |

Continued to be carbon neutral |

Achieved carbon neutralit※3 |

|

Sympathy for Management Philosophy |

4 or more/5 points |

4.22/5 points※4 |

※1. Figures after the 9th capital increase by JINUSHI REIT in January 2025.

※2. ESG clauses are incorporated into the template for lease land agreements and apply to contracts signed on or after June 9, 2022 (applicable only to our new development projects and domestic contracts).

※3. CO2 emissions (JINUSHI emissions) for the year ending December 31, 2023

※4. Score from an engagement survey conducted in December 2024 among employees of the JINUSHI group (excluding some subsidiaries) (response rate of 100%) (average of 3.54 points for other companies)