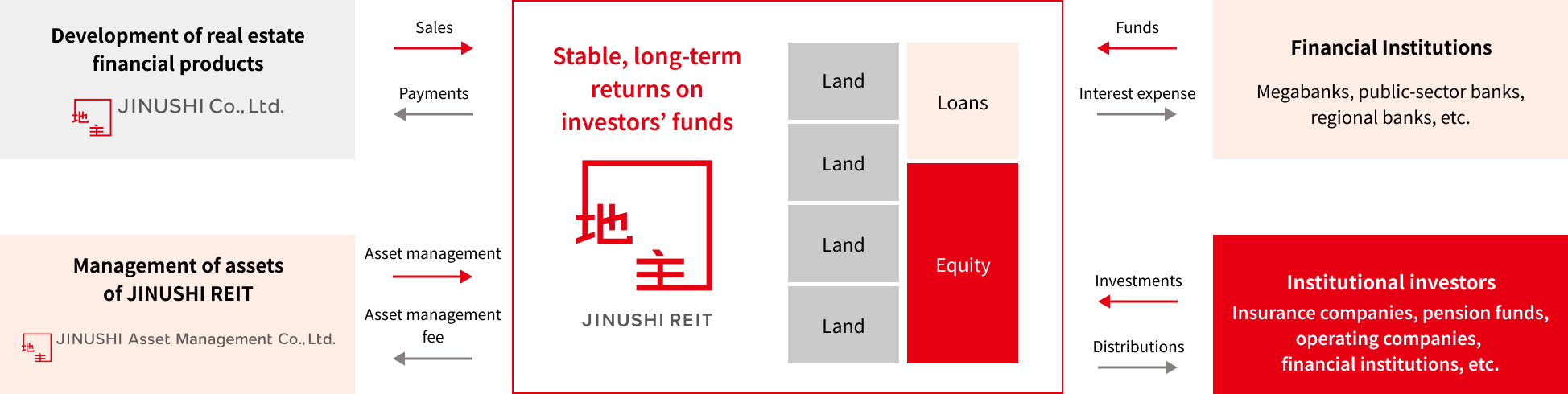

What is JINUSHI REIT?

As the only private REIT specializing in fixed-term land leasing in Japan, we provide stable long-term management of the funds of institutional investors. We have established a reputation as a "stable landlord" from tenants who desire long-term and stable business operations.

257.6billion yen

(7 th/out of 60 stocks)

188properties

(1 st/out of 60 stocks)

Only leased land

(only fund of this type in Japan)

335companies

Approx.

4%

AA-

(stable)

*As of January 9, 2025. The information in parentheses is based on our research (as of March 31, 2025).

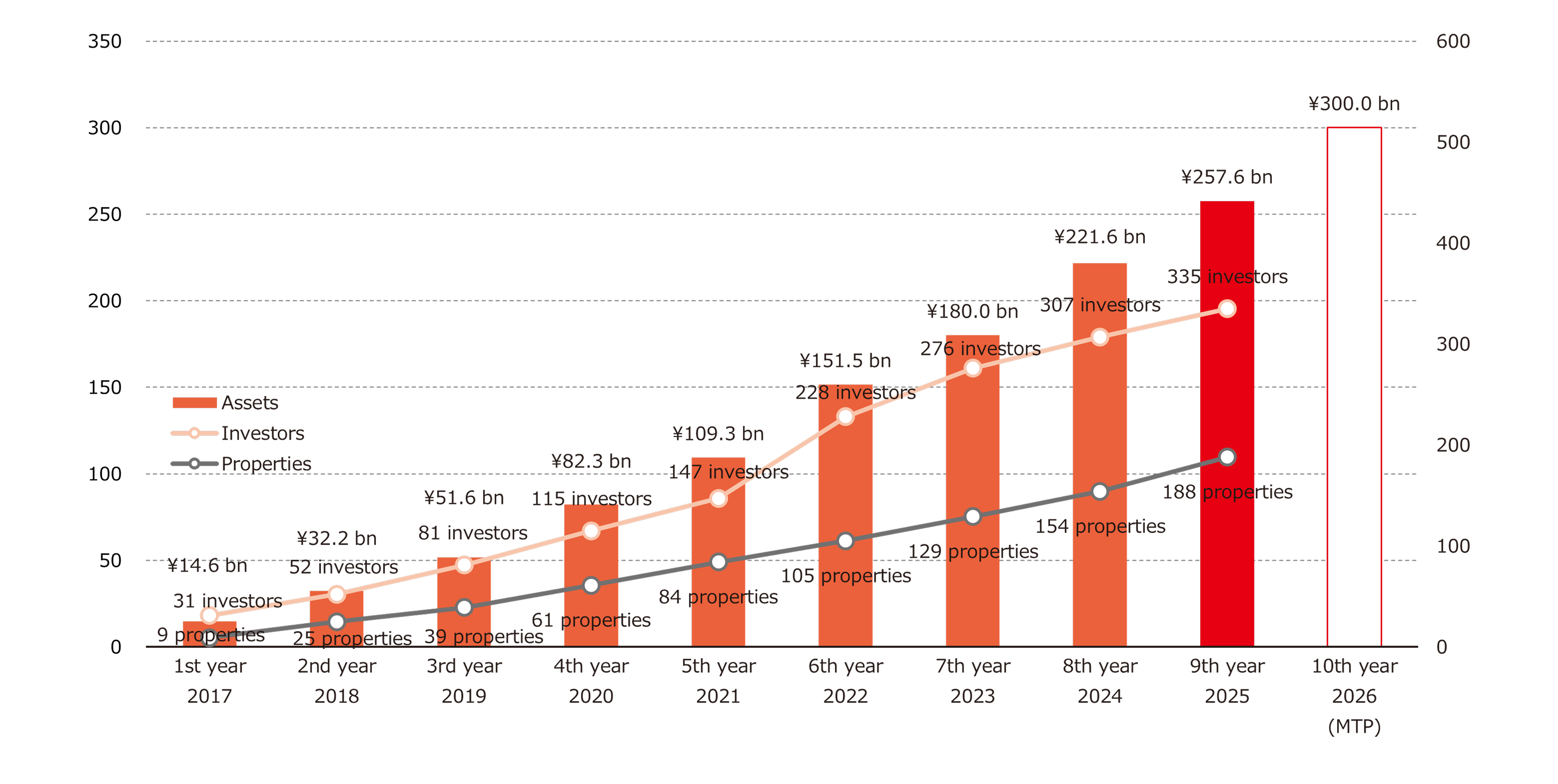

Change in Asset Scale

Utilizing sponsor support from JINUSHI Co., Ltd., JINUSHI REIT achieved the initial plan of 100 billion yen of assets in five years after starting operation. JINUSHI REIT now aims to reach 500 billion yen as soon as possible, and we have set a medium-term target of 300 billion yen as a milestone.

*The figures shown in the graph above reflect data immediately after the end of each recruitment (asset scope is basedonthe appraisal value at the time of acquisition; 2026 is the target of the medium-term management plan.).